United States

Securities and Exchange Commission

Washington, D.C. 20549

Schedule 14 A

PROXY STATEMENT PURSUANT TO SECTION 14(A)

OF THE SECURITIES EXCHANGE ACT OF 1934

(NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| Filed by the Registrant | ||

| Filed by a Party other than the Registrant | ||

Check the appropriate box: | |||

| Preliminary Proxy Statement | ||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under Rule 14a-12 |

| No fee required |

| Fee paid previously with preliminary materials. | ||||

| Fee computed on table |

| 2 |

MessagefromtheChiefExecutiveOfficer

| OUTLOOK: SHORT-TERM HEADWINDS At-home fitness, like many other consumer-focused industries, is undergoing short-term macro-economic challenges. On top of this, our industry and Nautilus experienced hyper-growth during the pandemic, resulting in some pull-forward of demand and the industry is now looking to find its post-pandemic footing. To weather the macro and sector challenges, we are staying grounded in our noble mission and unwavering dedication to build a healthier world, one person at a time. On a brighter note, during and after the pandemic, there appears to have been a profound and enduring shift in consumer fitness habits that favor at-home workouts, which we believe will enhance the long-term opportunity for our Company. The hybrid work model, where many work from home a portion of each week, has more consumers exercising at home than pre-pandemic. Pre-pandemic, 43% of U.S. adults surveyed by YouGov said they consistently worked out at home. Today, that number has grown to 64% and has held steady for more than two years. In our core target segment, this trend is even more pronounced, with |

In addition, connected fitness has enhanced consumers’ workouts, coupling equipment with content and innovative software to deliver superior fitness experiences. Instead of getting bored with a few “canned” workouts that traditionally came installed on equipment, connected fitness brings variety, freshness, progress tracking, coaching, and community that make their workouts more engaging and less routine. Nautilus is well-positioned to leverage both the long-term trend toward at-home workouts and connected fitness experiences.

We provide consumers a broad variety of superior products at a range of price points via our omnichannel distribution model. And we continue to enhance the portfolio with our differentiated JRNY® connected fitness offering.

With the ups and downs in our industry in recent years, it is easy to forget that we have been driving an ambitious transformation of our Company. We’ve made strong progress on all of our North Star pillars over the past two years, and I firmly believe that we have set the foundation for our path to become a leader in connected fitness by leveraging our equipment business and scaling a differentiated offering. All of this affirms our conviction in our North Star strategy, which is already paying off and will result in an even stronger Company as macro and industry conditions normalize.

Nautilus’ operating model is a strategic advantage to weather short-term, top-line challenges. Our asset-light manufacturing, diversified product portfolio, omni-channel distribution and semi-variable cost structure that enables tight management of margin, operating expenses and inventory level is a model built to flex with the variation of market conditions. In anticipation of a challenging outlook for the coming quarters, in February 2023, we took difficult actions as responsible operators to re-set our operating model, eliminating approximately $30M in costs. These reductions provide us additional agility to help us navigate the short-term to capture the long-term opportunity.

| 3 |

Strategic North Star Pillar Progress

| ADOPT A CONSUMER-FIRST MINDEST |

Our consumer-first positioning has transformed how we target our consumer segments and how we develop our products to meet their expectations. In addition to better meeting our customers’ needs in the development cycle, we are making great progress in our operations with a focus on better customer service and delivery. Our investments here are paying off with increased ROI on advertising and significant market share gains in our Direct business. We have also remedied past delivery challenges and have driven improvements resulting in 99% on-time delivery to our direct customers during fiscal year 2023. We are looking forward to launching a suite of new products carrying a refreshed Bowflex® brand identity later this year.

| Scale a Differentiated Digital Offering |

We continue to enhance and scale our differentiated digital offering, JRNY®, to better serve our customers and capture long-term revenue and profit. 80% of our products are JRNY®-enabled and JRNY® is now offered across the cardio portfolio including treadmills, bikes, and our proprietary Max Trainers, as well as available with bring your own device for our #1 selling SelectTech® dumbbells.

We have also made tremendous progress in bringing hyper-personalized experiences to JRNY® members. In FY 2023, we debuted JRNY® with Motion Tracking, which offers personalized form-coaching and feedback, rep counting, and individualized workout recommendations. This enhances our strength offerings with workouts that are designed for use with Bowflex® SelectTech® 552 and Bowflex® SelectTech® 1090 Dumbbells, and with Android or iOS tablets and mobile devices.

By transitioning our cardio portfolio to connected fitness as an installed base for JRNY®, introducing vision and motion-tracking technologies to our strength portfolio and enabling members to receive personalized real-time form-coaching and rep-counting using their mobile devices, we have laid a strong foundation for JRNY®. Additionally, we have been able to reduce near-term spend on JRNY® and keep connected fitness experiences much more affordable than our key competitors so that anyone can experience the benefits of connected fitness. As a result, we have continued to deliver total member growth. This has resulted in achievement of our 500,000 member goal, including 156,000 subscribers, each as of March 31, 2023.

| Focus Investments on Core Businesses |

To further enhance our ability to navigate near-term industry challenges, last month we announced several actions to enhance our balance sheet. This consisted of the sale of non-core assets, including the Nautilus® brand trademark assets and related licenses, for approximately $13 million. This enables us to continue to streamline our focus on our top brands and improve our debt position as we leveraged the net proceeds to pay down part of our term loan. The sale of the Nautilus® brand reflects a deliberate strategic branding approach we announced two years ago and will have minimal ongoing impact as our Bowflex®, Schwinn®, and JRNY® brands generate over 95% of our revenue.

| Evolve Supply Chain to be a Strategic Advantage |

We are achieving our transformative goal to turn our supply chain into a competitive advantage. This can be seen in tangible gross margin improvements driven by actions such as renegotiated inbound freight rates, as well as contract manufacturing costs for our top products. We have also significantly enhanced our delivery times to retailers, permitting them to order closer in time to when they need product, and we are rolling out a better last-mile delivery process for our Direct consumers. We closed our Portland, Oregon distribution center at the end of October 2022 and have successfully transferred inventory to our Columbus, Ohio and Southern California distribution centers - both strategically placed to optimize expedited deliveries.

| 4 |

| Build Organizational Capabilities to Win |

We continued to Shareholders

At our core, we excel at equipment. We continue to see demand for our fast-moving top sellers and traction in our Direct channel. Our focus remains on providing consumers with a broad variety of superior products at a range of price points. We have an exciting pipeline of new products planned for fiscal year 2024 with a strong lineup of updated connected fitness equipment carrying our innovative new Bowflex® visual branding.

While the entire home fitness industry struggles to find its post-pandemic footing and we are navigating an uncertain macro environment, we believe these challenges are short-term. We remain confident in the fitness category since our founding in 1986. Over the last year, the world has been profoundly challenged,long-term industry opportunity and our industry has seen an incredible evolutionown position due to our leading brands, comprehensive equipment portfolio, and omnichannel approach as we continue on our customers have adaptedpath to the realities of the COVID-19 pandemic. We believe this has created a long-term fundamental shift in consumer behavior, which we believe will significantly enhance the home fitness market for years to come. The combination of long-term assets, progress we’ve made before and during the pandemic, and a recently launched transformative strategic direction has resulted in Nautilus being better positioned to bebecoming a leader in the home fitness category than any other time in our 35-year history. I could not be prouder of the team’s efforts, our results, and our long-term prospects.

On behalf of all of us at Nautilus, I thank you for your continued support at the most exciting time in our Company’s long history.

Onwards and upwards,

Chief Executive Officer

| 5 |

Notice of Annual Meeting of Shareholders to

be held on August 2, 2023 as a Virtual Meeting

To the Shareholders of Nautilus, Inc.:

The annual meeting of shareholders of Nautilus, Inc. (the “Company”) will be held on Wednesday, June 16, 2021,August 2, 2023, at 1:8:00 p.m.a.m. Pacific Daylight Time. With the health and well-being of our shareholders, employees, directors, auditors, and those corporate partners who normallyTo expand shareholder access to attend the annual meeting, in mind and to reduce our costs and environmental impact, this year'syear’s annual meeting will be a completely virtual meetingheld virtually and will be conducted via our live webcast. Our embrace of the latest technology provides expanded access, improved communication and cost savings for our shareholders and the Company. We believe that hosting a virtual meeting will enable greater shareholders attendance and participation from any location around the world. You will not be able to attend the annual meeting in person. You will be able to participate in the annual meeting of shareholders online, vote and submit your questions during the meeting by visiting

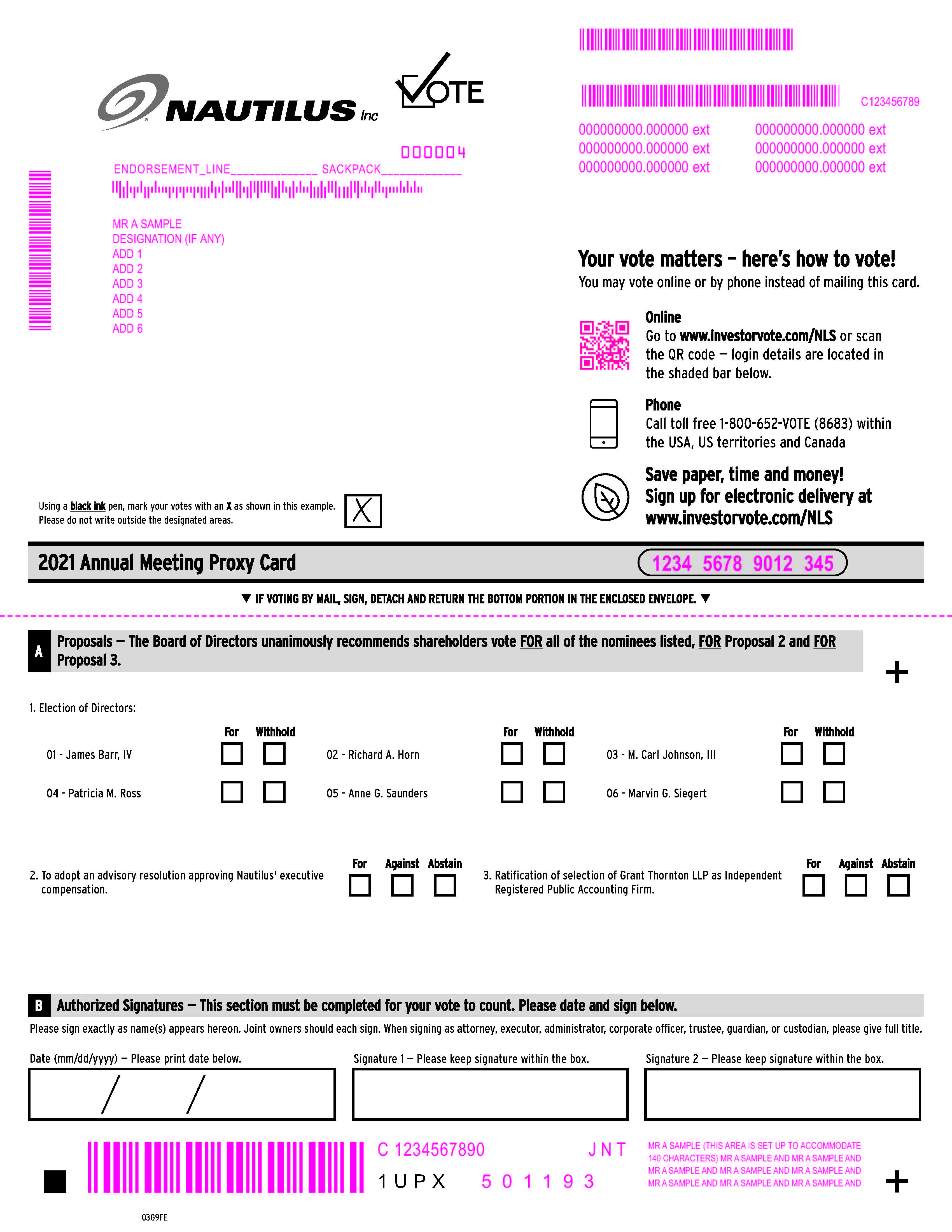

| To elect a Board of Directors, consisting of six (6) members, to serve until the next annual meeting of shareholders or until their successors are duly elected and qualified; |

| To approve the compensation of the named executive officers in a non-binding, advisory vote, as reported in this Proxy Statement; |

| To approve an amendment & restatement of the Nautilus, Inc. Employee Stock Purchase Plan; | ||||

| To ratify the Audit |

| To consider and act upon any other matter which may properly come before the annual meeting or any adjournment thereof. |

Only shareholders who held their shares at the close of business on April 16, 2021,June 5, 2023, the record date, are entitled to receive notice of and to vote at the annual meeting or any adjournment or postponement thereof.

All shareholders are cordially invited to participate in the annual meeting.

Whether or not you plan to participate in the annual meeting, please sign and promptly return the enclosed proxy card, which you may revoke at any time prior to its use. A prepaid, self-addressed envelope is enclosed for your convenience. Your shares will be voted at the annual meeting in accordance with your proxy.By Order of the Board of Directors,

Alan L. Chan

Secretary

Vancouver, Washington

Important Notice Regarding the Availability of Proxy Materials for the

Pursuant to rules promulgated by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a Notice of Annual Meeting, and a 2020 Annual Report to Shareholders, and by notifying you of the availability of our proxy materials on the Internet. The Notice of Annual Meeting, Proxy Statement and 2020FY 2023 Annual Report to Shareholderson Form 10-K are available at http://no cost at www.nautilusinc.com. In accordance with the SEC rules, the materials on the website are searchable, readable and printable, and the website does not have “cookies” or other tracking devices which identify visitors.

Proxy Statement Summary

when August 2, 2023 | where Virtual Meeting | record date June 5, 2023 | ||||||

Items of Business | Voting recommendation | |||||||

1 | To elect a Board of Directors, consisting of six (6) members, to serve until the next annual meeting of shareholders or until their successors are duly elected and qualified; | “FOR” all of the nominees | ||||||

2 | To approve the compensation of the named executive officers in a non-binding, advisory vote, as reported in this Proxy Statement; | “FOR” | ||||||

3 | To approve an amendment & restatement of the Nautilus, Inc. Employee Stock Purchase Plan; | “FOR” | ||||||

4 | To ratify the Audit Committee’s appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2024; and | “FOR” | ||||||

5 | Transact other business that may properly come before the annual meeting. | | ||||||

Your vote is very important Make your vote count. Please cast your vote as soon as possible, even if you plan to attend the 2023 annual meeting. For information about registering, attending, and voting at the 2023 annual meeting, please see “Participating in the Annual Meeting” on page 8 of the proxy statement | | Important Notice Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on August 2, 2023. The Notice of Annual Meeting of Shareholders, Proxy Statement, and FY 2023 Annual Report on Form 10-K are available at www.nautilusinc.com/investors. |

Vote by Internet Access the website indicated on the Notice of Internet Availability of Proxy Materials, proxy card, or voting instruction form. | Vote by Phone Call the number on the Notice of Internet Availability of Proxy Materials, proxy card, or voting instruction form. | Vote by Mail* Sign, date, and return the proxy card or voting instruction form in the postage-paid envelope. *if you requested paper material |

2 | | |

3 | | |

5 | | |

8 | | |

12 | | |

12 | | |

13 | | |

16 | | |

18 | | |

22 | | |

27 | | |

30 | | |

32 | | |

46 | | |

47 | | |

52 | | |

Appendix A | | Amended & Restated Nautilus, Inc. Employee Stock Purchase Plan |

Appendix B | |

| 8 |

Our Board of Directors (the “Board”) is furnishing this Proxy Statement and the accompanying Annual Report to Shareholders, Notice of Annual Meeting and proxy card in connection with its solicitation of proxies for use at our 20212023 annual meeting of shareholders (the “Annual Meeting”) or any adjournment thereof. The Annual Meeting will be held on Wednesday, June 16, 2021,August 2, 2023, beginning at 1:8:00 p.m.a.m., Pacific Daylight Time, online via live webcast at www.meetingcenter.io/276664349.The password for the meeting is NLS2021.

Our Board has designated the person named on the enclosed proxy card, Aina E. Konold, to serve as proxy in connection with the Annual Meeting. These proxy materials and the accompanying Annual Report to Shareholders are being mailed on or about April 29, 2021June 16, 2023 to our shareholders of record as of April 16, 2021.

We will be hosting the Annual Meeting live via Internet webcast. You will not be able to attend the meeting in person. A summary of the information you need to participate in the Annual Meeting online is provided below:

•Any shareholder may listen to the Annual Meeting and participate live via webcast at www.meetingcenter.io/276664349. The password for the meeting is NLS2021.https://meetnow.global/MZTV62J. The webcast will begin at 1:8:00 p.m.a.m. Pacific Daylight Time on Wednesday, June 16, 2021.August 2, 2023

•Shareholders may vote and submit questions during the Annual Meeting via live webcast.

•To enter the meeting, please have your 15-digit control number which is available on your proxy card. If you do not have your 15-digit control number, you will be able to listen to the meeting only, you will not be able to vote or submit questions during the meeting.

•Instructions on how to connect to and participate in the Annual Meeting via the Internet, including how to demonstrate proof of stock ownership, are posted at https://meetnow.global/MZTV62J.

www.meetingcenter.io/276664349.

If you are a shareholder of record, there are several ways to vote:

•by participating in the Annual Meeting and voting according to the instructions posted at https://meetnow.global/MZTV62J;www.meetingcenter.io/276664349;

•by completing and mailing your proxy card (if you receivedrequested printed proxy materials); or

•by following the instructions on your proxy card for voting either online or by phone.

Even if you plan to participate in the Annual Meeting, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to participate in the Annual Meeting.

If you are a street name shareholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. Street name shareholders should generally be able to vote by returning an instruction card, or by telephone or on the Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank or other nominee. As discussed below, if you are a street name shareholder, you may not vote your shares live during the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee

We will be hosting the Annual Meeting via live webcast on the Internet. You will not be able

What do I need in order to be able to participate in the Annual Meeting online?

You will need the 15-digit control number included on your proxy card in order to be able to vote your shares or submit questions during the meeting.

Instructions on how to connect and participate in the Annual Meeting via the Internet, including how to demonstrate proof of stock ownership, are posted atIf you are a shareholder of record, you may change your vote or revoke any proxy you execute at any time prior to its use at the Annual Meeting by:

•delivering written notice of revocation to our Secretary at the address provided on the first page 1 above;of this proxy statement; or

•delivering an executed proxy bearing a later date to our Secretary at the address provided on the first page 1 above.

To revoke your proxy and vote during the Annual Meeting, follow the instructions posted at

If you are a street name shareholder, your broker, bank or other nominee can provide you with instructions on how to change your vote.

Our Board has fixed the close of business on April 16, 2021June 5, 2023 as the record date for determining which of our shareholders are entitled to notice of and to vote at the Annual Meeting. At the close of business on the record date, 30,576,289 31,986,018 shares of our common stock were outstanding.

Each share of common stock outstanding on the record date is entitled to one vote per share at the Annual Meeting. Shareholders are not entitled to cumulate their votes. The presence, online at the virtual meeting or by proxy, of the holders of a majority of our outstanding shares of common stock is necessary to constitute a quorum at the Annual Meeting.

| 9 |

Votes Required to ApproveApprove Each Proposal

If a quorum is present at the Annual Meeting:

(i)

(ii)

(iii)the amendment & restatement of the Nautilus, Inc. Employee Stock Purchase Plan will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast against it; and

(iv)

You may vote “FOR” or “WITHHOLD” authority to vote for the nominees for election as directors. If you vote your shares without providing specific instructions, your shares will be voted FOR the nominees for election to the Board of Directors. If you vote to “WITHHOLD” authority to vote for the nominees for election as directors, the shares represented will be counted as present for the purpose of determining a quorum, but they will not be counted as a vote cast on the proposal and will have no effect in determining whether a nominee is elected.

You may vote “FOR” or “AGAINST” or “ABSTAIN” from voting when voting on the proposals regarding the advisory vote on named executive officer compensation, the amendment & restatement of the Nautilus, Inc. Employee Stock Purchase Plan, and the ratification of the selectionappointment of the independent registered public accounting firm. If you choose “ABSTAIN” from voting on a proposal, your shares represented will be counted as present for the purpose of determining a quorum but will not be counted as votes cast on the proposal and will have no effect in determining whether the proposal is approved.

Broker non-votes, as explained below, will not be counted as votes cast on any proposal and will have no effect in determining whether any proposal at the Annual Meeting is approved.

If your shares are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the Notice of Annual Meeting was forwarded to you by your broker or nominee, who is considered the shareholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. Beneficial owners are also invited to participate in the Annual Meeting. However, since a beneficial owner is not the shareholder of record, you may not vote your shares of our common stock at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. If you request a printed copy of our proxy materials by mail, your broker, bank or other nominee will provide a voting instruction form for you to use. Throughout this proxy statement, we refer to shareholders who hold their shares through a broker, bank or other nominee as “street name shareholders.”

If you hold your shares in street name, your broker, bank or other similar institution may be able to vote your shares without your instructions depending on whether the matter being voted on is “discretionary” or “non-discretionary.” In the case of a discretionary matter (for example, the ratification of the independent registered public accounting firm), your broker is permitted to vote your shares of common stock if you have not given voting instructions. In the case of a non-discretionary matter (for example, the election of directors, the amendment and restatement of the Employee Stock Purchase Plan and the advisory vote to approve named executive officer compensation), your broker cannot vote your shares if you have not given voting instructions.

A “broker non-vote” occurs when your broker submits a proxy for the Annual Meeting with respect to discretionary matters, but does not vote on non-discretionary matters because you did not provide voting instructions on these matters. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum, but are not counted as votes cast for a proposal and will have no effect on the outcome of any proposal.proposals at the Annual Meeting. Therefore, it is important that you provide specific voting instructions to your broker, bank or similar institution.

When a proxy card is properly dated, executed and returned, the shares it represents will be voted at the Annual Meeting in accordance with the instructions specified in the proxy. If no specific instructions are given, the shares will be voted FOR the election of the director nominees described below, FOR the proposal to approve, on a non-binding, advisory basis, the compensation of our named executive officers as set forth in the proxy statement, FOR the amendment & restatement of the Nautilus, Inc. Employee Stock Purchase Plan, and FOR the ratification, on a non-binding, advisory basis, of Grant Thornton LLP as our independent registered public accounting firm for the transition period ended March 31, 2021 and fiscal year ending March 31, 2022.2024. If other matters come before the Annual Meeting, the persons named in the accompanying proxy will vote in accordance with their best judgment with respect to such matters. If the Annual Meeting is adjourned, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions, as described above.

We will bear all costs associated with the solicitation of proxies in connection with the Annual Meeting. We do not plan to hire a proxy solicitor, but to the extent we choose to use proxy solicitor services, we will pay the related fees and expenses.

Procedures for Shareholder Proposals and Nominations

Shareholders interested in submitting a proposal for inclusion in our proxy materials and for presentation at the FY 2024 annual meeting of shareholders may do so by following the procedures set forth in Rule 14a-8 under the Exchange Act. Rule 14a-8 addresses when we must include a shareholder proposal in our proxy materials, including eligibility and procedural requirements that apply to the proponent. In general, to be eligible for inclusion in our proxy materials, shareholder proposals must be received by our Secretary no later than February 17, 2024.

| 10 |

In addition to the requirements of Rule 14a-8, all shareholders proposals, including any director nomination, must comply with the notice requirements contained in our amendedAmended and restated bylaws, as amendedRestated Bylaws (“Bylaws”), nominationswhich requires, among other things, detailed information concerning the shareholder making the proposal (and the beneficial owner on whose behalf the proposal is made, if any), the name and address of the shareholder, specific information concerning such shareholder’s interests in our securities and a commitment by any proposed director nominee to serve the full term if nominated and elected. In addition, the notice must include the recommended director nominee’s name, biographical data, qualifications, and details regarding any material monetary agreements between the shareholder and the proposed nominee. In order for directors at an annual meeting may be made only by (1) thea nomination of persons for election to our Board or a committeeproposal of the Board, or (2) a shareholder entitledbusiness to vote who has delivered notice to us within 120 to 180 daysbe properly brought before the first anniversary of the date of the mailing of the notice for the preceding year's annual meeting.

In addition to satisfying the requirements under our Bylaws with respect to advance notice of any director nomination, any shareholder who intends to solicit proxies in support of director nominees other than the Company’s nominees in accordance with Rule 14a-19 must provide the required notice of intent to solicit proxies to the Corporate Secretary no later than 60 calendar days prior to the first anniversary of the date of the 2023 Annual Meeting (no later than June 3, 2024 for the FY 2024 annual meeting of shareholders).

Under Rule 14a-4(c) of the Exchange Act, our Board may exercise discretionary voting authority under proxies solicited by it with respect to any matter properly presented by a shareholder at the FY 2024 annual meeting of shareholders that the shareholder does not seek to have included in our proxy statement if (except as described in the following sentence) the proxy statement discloses the nature of the matter and how our Board intends to exercise its discretion to vote on the matter, unless we are notified of the proposal on or before May 2, 2024, and the shareholder satisfies the other requirements of Rule 14a-4(c)(2). If we first receive notice of the matter after May 2, 2024, and the matter nonetheless is permitted to be presented at the FY 2024 annual meeting of shareholders, our Board may exercise discretionary voting authority with respect to the matter without including any discussion of the matter in the proxy statement for the meeting. We reserve the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with the requirements described above and other applicable requirements.

We willplan to announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to the Current Report on Form 8-K after they become available.

We file our annual reports, quarterly reports, current reports, proxy statements and other information with the SEC under the Securities Exchange Act of 1934, as amended (“Exchange Act”). The SEC maintains an Internet sitea website at http://www.sec.gov/www.sec.gov where you can obtain copies of most of our SEC filings. We also make available, free of charge, on our website

We filed our Annual Report on Form 10-K for FY 2023 (“FY 2023 Annual Report”) with the SEC on June 1, 2023. Our FY 2023 Annual Report is being made available to our shareholders concurrently with this Proxy Statement and does not form part of the proxy solicitation material. It is also available free of charge at the SEC’s web site at www.sec.gov. Upon written request by a shareholder, we will mail, without charge, a copy of the FY 2023 Annual Report, including the financial statements and financial statement schedules, but excluding exhibits to the FY 2023 Annual Report. Exhibits to the FY 2023 Annual Report are available upon payment of a reasonable fee, which is limited to our expenses in furnishing the requested exhibit. Such requests may be made by writing to our Secretary at the address included on the first page of this proxy statement.

| 11 |

Our Vision

To build a healthier world, one person at a time.

Our Mission

We empower healthier living through individualized connected fitness experiences.

| 12 |

Environmental, Social, and Governance (ESG)

In our effort to build a healthier world, one person at a time, we strive to make a positive impact on the global fitness industry, our community, and our planet with a commitment to embody transparent, socially conscious, and sustainable business practices. The importance of ESG is reflected throughout our organization – from formally delegating oversight and accountability for ESG matters to the Corporate Governance Committee of our Board of Directors to the creation of the ESG Employee Committee. The ESG Employee Committee was started in 2022 and includes a core group of Nautilus employees with oversight from members of our executive leadership team and the Board of Directors. The initial focus of the ESG Employee Committee is to assess our current activities and impact and then evaluate potential goals and action to further the ESG priorities that are being established by our Board of Directors. The following sections highlight some of our achievements, practices and developing goals related to ESG matters.

At Nautilus, we understand that sustainability is a critical component of our business strategy. By implementing sustainability initiatives throughout our operations, supply chain and product lifecycle, we intend to improve the resource efficiency of our business, decrease our environmental-related risks, and reduce our environmental impact. We also strive to comply with all federal, state, and local environmental regulations and laws at our U.S. locations, and we work closely with our overseas partners to comply with local environmental requirements. In FY 2023, we continued assessing our risks, identifying areas of focus, and evaluating appropriate and achievable solutions related to improving our resource efficiency, decreasing environmental risk, and reducing our environmental impact. Some of the measures we have taken already include:

Reducing our carbon footprint

•We use controlled and LED lighting in our headquarters and distribution centers

•We provide electric car charging stations for employee use at 75% of our domestic facilities

•We transitioned industrial equipment in our distribution centers from propane to electric power

•We have begun initiatives to introduce the use of solar power in our distribution centers

Reducing landfill waste

•We introduced processes to maximize recycling potential, including separating out metals during obsolete material scrapping, recycling all cardboard/paper/fill, and salvaging damaged pallets

•We recycled over 20,000 lbs. of metal during FY 2023

•We introduced green packaging initiatives and our Quality & Engineering Teams are continually working with our suppliers to identify environmentally conscious packaging alternatives to expanded polystyrene foam (EPS) products

Safety and compliance with chemical regulations

•Rigorous testing and compliance with regulations including RoHS, Prop65, Toxics in Packaging Clearinghouse (TPCH), product lead paint testing

•Associated recordkeeping including Safety Data Sheets (SDS)

ESG Standards & Audits

•Conducted internal ESG training, created audit procedures, and conducted ESG-related audits for 95% of our suppliers

•Ensured supplier compliance with RoHS for all products

•Ensured supplier compliance with California Air Resources Board (CARB) & Toxic Substances Control Act (TSCA)

| 13 |

Values

Consumer-obsessed

We exist to serve the consumer’s needs and wants, using data and our deep consumer knowledge to drive our decision making

Focused

We are committed to focus on fewer, bigger, bolder bets and seek simplicity in all we do

Ambitious Innovators:

We think big, seek to be the disruptors, and innovate on differentiating experiences that make an important difference in our consumers’ lives

Problem Solvers

We are diligent and accountable to ourselves and our teams by taking responsibility, providing transparency, and adhering to the highest ethical standards

Care Deeply

We care deeply about our employees, partners, shareholders, and communities where we do business and go above and beyond to be inclusive and create a positive environment where everyone’s contributions are valued

Win Together

We put our teams above ourselves, pushing and supporting each other, and having fun as we work together as a team to accomplish our goals

Our employees demonstrate integrity every day in their display of Contentsstrong ethical and moral principles. These principles are also codified and guided by our compliance practices such as:

Code of Business Conduct

& Ethics

Our Code of Conduct that articulates our:

•Anti-discrimination policy

•Anti-bribery policy

•Conflict of interest policy

Ethics Hotline

•All complaints investigated. No violations of the Code of Conduct found.

Insider Trading Policy

•Restricted Persons policy including Blackout Period and Pre-Clearance procedure

•No short term or speculative trading permitted including hedging

Human Rights

•No forced or compulsory labor at the Company or our Suppliers

•No child labor at the Company or our Suppliers

At Nautilus, we are committed to creating and supporting a positive company culture that attracts and retains talent, engages with employees, and promotes wellness, while ensuring diversity, equity, and inclusion for all employees. Every member of Team Nautilus brings a unique background and skills to our company. We celebrate our differences but are united by our mission. We are a dynamic team driving the future of consumer fitness experiences through our well-known brands and a passionate company culture. Our culture is shaped by our Values and our Integrity:

| 14 |

Our People

Our People are the foundation of Nautilus, each representing our Values wherever we work. We foster an environment where we value diversity and unique contributions from each of our team members. We create a trusting, open, and inclusive environment by treating each person in a manner that reflects our core values. We are committed to creating an inclusive environment for our employees, customers, partners, and the communities in which we live, work, and play. Our goal is to positively impact our employees and our communities.

We believe in and invest in the well-being of our employees through a total rewards strategy that includes a competitive salary, incentives, health, welfare, and retirement benefits designed to encourage physical, financial, and emotional/social well-being.

We have been recognized as one of The Oregonian/OregonLive’s’ TOP WORKPLACES since 2013. Through employee nominations and surveys, the Top Workplaces competition identifies those workplaces in Oregon and Southwest Washington that are happy, stimulating, nurturing, and productive.

Domestically and internationally, our employees, suppliers and partners are expected to act in a manner consistent with our Values, our Code of Business Conduct & Ethics, and U.S. and international law.

Diversity, Equity, and Inclusion:

We are committed to a diverse, equitable and inclusive workplace to better serve our customers and communities. This includes increased and improved outreach, recruitment, hiring and retention of diverse groups at all levels of the workforce. We strive to ensure employees are included and fairly treated within all levels of the organization and that all feel welcomed, valued, and respected. We also are continuous learners, constantly seeking growth and development through Nautilus University including understanding DEI issues and initiatives. This diversity of perspectives, experiences and backgrounds makes us stronger and provides a competitive advantage.

Executive Management team

Employee Resource Groups

The Women in Leadership and Allies (WILA) group is a collaborative group of women leaders and allies at all levels of the Company who have come together to inspire, empower, educate, and encourage each other, while elevating the power of women’s voices in the Company and their communities.

The Veterans Group is a group of employee veterans and allies focused on increasing awareness, supporting veterans, and improving understanding of veterans in the workplace and community.

EMPLOYEE ORGANIZATIONS

The IDEA (Inclusion, Diversity, Equity & Accessibility) committee is an employee committee that helps guide the Company in building and implementing plans that further our efforts to grow a diverse, equitable, and inclusive workforce and offers employees opportunities to connect and dialogue with colleagues on important topics. During FY 2023, the IDEA committee helped design and roll-out a company-wide implicit bias workshop. They also hosted a number of outside presenters/speakers that led discussions with employees on topics ranging from ethnic diversity to neurodiversity.

| 15 |

The Wellness Committee is an employee committee with a mission of empowering healthier living to build a better world, one employee at a time.

The Culture Club is a group of employees whose mission is to facilitate employees getting to know each other through organizing and hosting events for employees and their families.

Safety

Nautilus pledges to maintain a safe work environment across its locations, including its headquarters, distribution centers and first tier supplier base. FY 2023 was the first year we included all Company locations and 95% of our first tier supplier base in our audits, ensuring a designated person to manage health and safety policies and procedures as well as implementation. Our suppliers undergo yearly internal audits and third-party audits managed by our retail customers. We are committed to immediately addressing any issues that may arise whether found internally or externally.

•We achieved a 66.67% reduction in recordable incidents in our network year-over-year1, resulting in an overall Total Recordable Incident Rate (TRIR) of 0.26. This is best in class performance as compared to similar industry averages of 4.8 in Warehousing and 1.9 in Administrative and Support Services2.

•On average, our safety record saved the Company approximately $130K in calendar year 2022 compared to comparable companies3.

1TRIR is measured on a calendar year basis. Nautilus had 3 recordable incidents in 2021 and 1 recordable incident in 2022.

2Bureau of Labor Statistics (https://www.bls.gov/web/osh/summ1_00.htm)

3Based on the National Safety Council average of $42,000 per medically consulted injury (https://injuryfacts.nsc.org/work/costs/work-injury-costs/) multiplied by the average Warehousing and Administrative and Support Services TRIR of 3.35.

Nautilus University:

Nautilus University is our learning and development platform that was launched on May 18, 2022 that provides courses to improve the personal and professional development of our employees.

•Over 3,000 classes ranging from professional competencies, leadership, mental health and DEI completed since launch.

•Hosted 94 live, instructor-led professional development workshops

•Over 100 individual development plans completed.

•Over 200 employees completed implicit bias training.

Philanthropy and Community:

At Nautilus, we are committed to supporting the communities in which we work, play, and live. We value our philanthropic partnerships with businesses, academic institutions, and non-profit organizations serving our communities, and our charitable contributions focus on supporting these partnerships.

•We donated home fitness equipment valued at over $41,000 to non-profit organizations across the U.S., including Medical Teams International, Bike Clark County, Boys & Girls Clubs – Central Ohio, Cleveland National Forest – Trabuco Ranger District, Heron Creek Therapeutic Program, and RAPID.

•Nautilus provides 8 hours of Paid Volunteer Time per year to all employees to positively impact their communities. During FY 2023, 124 employees volunteered 932 hours of their time with organizations including Chapple Hill Cat Sanctuary, Clark County Food Bank, Bay Area Crisis Nursery, Watershed Alliance, and Shop with a Cop.

| 16 |

Human Rights

We prohibit forced, compulsory or child labor and believe in the potential and dignity of every individual who is a member of Team Nautilus whether directly employed or indirectly employed with our suppliers. We validate compliance with our human rights policies through internal and third-party audits. In FY 2023, we broadened the criteria used in our social audits by using a combination of retail customer requirements and Sedex audit criteria to cover 95% of our supplier base. Third-party audits were also conducted by the Business Social Compliance Initiative and Sedex which provided validation of our internal audit results. Our internal and third party audits, did not identify any forced, compulsory or child labor at the Company or at any of our suppliers in FY 2023.

Our Board is responsible for providing oversight of the Company’s business and affairs, including the Company’s strategic direction and the management of the financial and operational execution that will best facilitate the success of the business and support the long-term interests of our shareholders. To effectively support its responsibilities, the Board has three standing committees: an Audit Committee, a Compensation Committee and a Corporate Governance Committee. Each of these Board committees is comprised solely of independent directors. These Board committees carry out the responsibilities set out in the specific committee charters approved by the Board that are consistent with applicable requirements of the New York Stock Exchange (“NYSE”) and the Securities and Exchange Commission (“SEC”). The Board and each committee may from time-to-time form other committees or sub-committees for specified purposes. The Board and each committee may also, at its discretion, retain outside advisors at the Company’s expense in carrying out its responsibilities.

Our Board is committed to good corporate governance practices and seeks to represent shareholder interests through the exercise of sound judgment. To this end, the Board has adopted Corporate Governance Policies (“Governance Policies”) that provide the framework for the governance of the Board and Company and a Code of Business Conduct and Ethics (“Code of Conduct”) that represents our commitment to the highest standards of ethics and integrity in the conduct of our business. The Board committee charters, the Governance Policies and the Code of Conduct, as well as any amendments we may make to these documents from time to time, may be found on the Investor Relations section of our website under “Corporate Governance” at https://www.nautilusinc.com/investors/corporate-governance/, and together with our charter and bylaws, serve as our governance and compliance framework. Please note that information on our website is not incorporated by reference into this Proxy Statement and should not be considered part of this document.

Commitment to Board Diversity

As reflected in our Governance Policies, we are committed to building a Board that consists of the optimal mix of members that represent a diversity of skills, experiences, expertise, and backgrounds capable of effectively overseeing the Company’s business strategy and risk management. Our Board consists of highly engaged, independent, and diverse directors who are actively involved in strategic, risk, and management oversight.

Board Refreshment

The Board believes the fresh perspectives brought by newer directors are critical to a forward-looking and strategic Board when appropriately balanced with the deep understanding of our business provided by longer-serving directors. Accordingly, we have maintained a deliberate mix of new and tenured directors on the Board and the Corporate Governance Committee is focused on ensuring the optimal mix of tenures, backgrounds, skills, and perspectives. Since 2020, Nautilus has added four new directors with diverse backgrounds and experiences to enhance the oversight of our strategic goals and initiatives and contribute to the development and expansion of the Board’s knowledge and capabilities.

| 17 |

General/Executive Management: Experience planning, leading and managing a business.

Consumer Marketing: Experience with consumer product and services marketing across all mediums.

Strategy: Experience formulating and facilitating strategic initiatives including business partnerships and M&A.

Innovation/Product Development: Experience bringing consumer products and services from concept to market.

Finance & Accounting: NYSE Section 303.07 financially literate or SEC Reg S-K Item 407 financial expert.

Digital/Subscriptions: Experience with a software subscription business.

ESG: Experience with Sustainability,

DEI and Governance.

Supply Chain/Logistics: Experience with Demand Planning, Procurement, Supply Chain Operations, Manufacturing, and Logistics.

OmniChannel: Experience with selling consumer products in a variety of distribution channels including e-Commerce, Direct and Retail channels.

Talent Management: Experience with attracting, developing, and retaining talent.

Proposed Board of Directors

Diversity

Key Skills

| 18 |

According to our Bylaws, our Board shall be comprised of not less than five (5) nor more than fifteen (15) directors, provided, however that the number may be otherwise set by resolution of our Board. The Board has fixed the authorized number of our directors at six (6).

At this Annual Meeting, our shareholders will elect a board consisting of six (6) directors to serve until our 2022FY 2024 annual meeting of shareholders or until their respective successors are elected and qualified. Our Board has nominated the individuals listed below to serve on our Board. All of the nominees are currently members of our Board. If any nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, our Board may provide for a lesser number of directors or designate a substitute. If our Board designates a substitute, the proxy holders will have the discretionary authority to vote for the substitute. Proxies may not be voted for more than six (6) nominees.

OUR BOARD UNANIMOUSLY RECOMMENDS YOU VOTE “FOR” EACH OF THE FOLLOWING NOMINEES FOR ELECTION AS DIRECTOR:

Name | Age | Director Since | Independent | Other Public Boards |

James “Jim” Barr, IV | 60 | 2019 | No | - |

Anne G. Saunders | 61 | 2012 | Yes | 2 |

Patricia “Patty” M. Ross | 58 | 2020 | Yes | 1 |

Kelley Hall | 51 | 2021 | Yes | - |

Shailesh Prakash | 54 | 2021 | Yes | - |

Ruby Sharma | 56 | 2022 | Yes | 3 |

| | James “Jim” Barr, IV Jim joined Nautilus, Inc. as Chief Executive Officer and Board Member in July 2019. He brings with him key capabilities of driving growth through people leadership, consumer-driven marketing, innovation and technology, as well as multiple successes transforming and growing large scale digital and multichannel businesses in diverse industries. Before joining Nautilus, Inc., from 2014 to 2018, Mr. Barr was Group President of Ritchie Bros., a global leader in the sales of used industrial equipment. Prior to that Mr. Barr held the position of EVP and Chief Digital Officer of OfficeMax where he led the transformation of its online and omnichannel experiences. In 2008, Mr. Barr was named the first President of Sears Holdings’ newly-formed Online Business Unit, where he developed and drove an omnichannel and online strategy that rapidly expanded the product assortment and growth. Mr. Barr’s foundational digital experiences came as an executive for 12 years in Microsoft’s online businesses as GM, Commerce Services, where he led Microsoft’s B2C ecommerce businesses, such as online shopping, shopping search, classified advertising and auctions, as well as underlying technology platforms, and, before that was GM, MSN Business Development. Mr. Barr holds a B.S. from Miami University, and an M.B.A. in Finance from the University of Chicago Booth School of Business. Our Board has determined that Mr. Barr’s experience as an executive across a diverse array of industries and his experience with e-commerce and subscription businesses, among other things, makes him highly qualified to serve on the Board. |

| 19 |

Anne G. Saunders

Anne joined our Board in April 2012 and currently serves as the Chair of the Board and a member of the Audit Committee. Since November 2017, Ms. Saunders has been a non-executive director of the Swiss Water Process Decaffeinated Coffee Company (TSX: SWP), a global leader in natural process green coffee decaffeination, where she chairs the salesCorporate Governance and Compensation Committee. Since March 2019, Ms. Saunders has also served as a non-executive director for the WD-40 Company (NASDAQ: WDFC) a global consumer products company with an iconic brand. She chairs the Compensation Committee, and also serves on the Nominating/Governance Committee. From April 2016 to January 2017, Ms. Saunders was U.S. President of used industrial equipment. PriorNakedWines.com, where she delivered record growth for a disruptive e-commerce business selling boutique wines directly to consumers. From September 2014 to April 2016, Ms. Saunders was U.S. President of FTD, Inc. (NYSE: FTD), where she ran the P&L for the $1B US e-commerce floral and gifting businesses. From August 2012 to January 2014, Ms. Saunders was President of Redbox, a $2B company that Mr. Barr held the position of EVPrevolutionized home entertainment. From March 2009 until January 2012, Ms. Saunders was Executive Vice President and Chief DigitalMarketing Officer for Knowledge Universe, a privately-held, multi-brand, for-profit education company with 1,800 schools globally. From February 2008 until March 2009, Ms. Saunders was Senior Vice President, Consumer Bank Executive and, from May 2007 until February 2008, she was Senior Vice President, Brand Executive, for Bank of OfficeMax where he led the transformationAmerica Corporation (NYSE: BAC). Between 2001 and 2007, Ms. Saunders held a variety of its onlinepositions with Starbucks Coffee Co. (NASDAQ: SBUX), including Senior Vice President, Global Brand, during that company’s period of most rapid domestic and omnichannel experiences. In 2008, Mr. Barr was named the first President of Sears Holdings’ newly-formed Online Business Unit, where he developedinternational growth. Ms. Saunders has also held executive and drove an omnichannelsenior management positions with eSociety, a Saas e-commerce platform, AT&T Wireless and online strategy that rapidly expanded the product assortment and growth. Mr. Barr’s foundational digital experiences cameYoung & Rubicam. Additionally, Ms. Saunders served, from 2006 until 2007, as an executivea director for 12 years in Microsoft’s online businesses as GM, Commerce Services, where he led Microsoft’s B2C ecommerce businesses, such as online shopping, classified advertising and auctions, as well as underlying technology platforms, and, before that was GM, MSN Business Development. Mr. Barr holdsBlue Nile, Inc. (NASDAQ: NILE). She received a B.S.B.A. from MiamiNorthwestern University and an M.B.A. in Finance from the University of Chicago Booth School of Business.

Our Board has determined that Mr. Johnson has the requisiteMs. Saunders’s more than a decade of public board experience and expertisesuccess as a CEO and President of e-commerce and subscription businesses, across an array of diverse industries: retail, manufacturing, telecom, fintech, software development, entertainment/content, among other things, makes her highly qualified to be a director of Nautilus based on his consumer marketing expertise and strong background in corporate expansion strategy.

Patricia “Patty” M. Ross, 56,

Patty joined the Board in March 2020 and currently serves as the Chair of the Corporate Governance Committee and Chair of the Compensation Committee. Ms. Ross has served as Founder and Principal of PMR Consulting, LLC, a management consulting company since March 2017. Ms. Ross joined the Board in March 2020 and currently serves as a member of the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. She is an accomplished Senior Executive who leverages her experience, leadership acuity, and definitive record, positioning her as a go-to global strategist in the consumer product industry. Ms. Ross most recently served Apple (NASDAQ: AAPL) as an Executive Advisor for the People organization, where she delivered talent management, retention, inclusion, and diversity strategies across all US and global divisions sincefrom November 2019 (NASDAQ: AAPL).to February 2020. From 1992 to March 2017, Ms. Ross spent her career with Nike (NYSE: NKE), where she dedicated over 34 years in strategy, process re-engineering, operations, and general management roles. Including GM, Asia Pacific Equipment; Senior Director, Global Footwear; VP, Global Product Process Innovation, and finally a VP in Global Operations, Innovation & Technology. She is routinely trusted and relied upon to start up new

| 20 |

divisions, functional units, and incubators, charged with implementing change, innovation, and growth. Her direct efforts led to millions of revenue dollars for Nike annually. In addition to her professional contributions at Nike, Ms. Ross gained a reputation for both innovative excellence and reliable execution by spearheading value initiatives such as the first e-commerce B2B website for retailers, Nike’s Product Creation Center of Excellence, Nike’s Workplace of the Future, and the Women of Nike Diversity Network.

Ms. Ross holds a Bachelor of Applied Science degree in Marketing and Finance from Portland State University, a coaching certification in Executive Leadership Development from The Hudson Institute of Coaching, and an Advanced Management certificate in Business Administration and General Management from Harvard Business School. She is alsoAs a global executive, Ms. Ross brings knowledge of public board governance through current board experience, prior interactions with boards and committees as an executive, and the formal training and graduate of the Executive Board Education Program atCertification from Harvard Business School where she focused on corporate boards, governance, operations, and management.NACD Directorship Certified™ from the National Association of Corporate Directors. In addition to growing and reshaping organizations as a strategic advisor and operations leader, PattyMs. Ross is also active in various professional boards and speaking engagements. Ms. RossAs a current board member, Patty serves as a Board Member foron the Compensation and Chair of the ESOP Committee of MMC Corp, a providerand Chair of preconstructionthe Nominating and constructive services, since January 2020,Governance Committee and an Advisor to ThenWhat, Inc., a brand strategymember of the Audit and content creation agency, since February 2020, and Caterpillar, Inc. (NYSE: CAT), a manufacturerCompensation Committees of construction and mining equipment, since March 2014.Movella (NASDAQ: MVLA). She is also an active member of the National Association of Corporate Boards (NACD), Athena Alliance, WomenExecs on Boards, and Women Corporate Directors (WCD), and the International Coaching Federation (ICD), where she is committed to the professional development of executives of all ages.

Our Board has determined that Ms. Ross has the requisite experience to be a director of Nautilus. Ms. Ross brings to our Board a strong background in consumer products, corporate governance, talent development, and operations expertise to Nautilus.

Kelley Hall

Kelley joined our Board in April 2012. Ms. Saunders is the Chairman of the NominatingOctober 2021 and Corporate Governance Committee andcurrently serves as a member of the Audit Committee and the Compensation Committee. Since November 2017, Ms. Saunders has been a non-executive director ofShe is the Swiss Water Process Decaffeinated Coffee Company (TSX:SWP), a global leader in natural process green coffee decaffeination, where she Chairs the Corporate Governance and of Compensation Committee. Since March 2019, Ms. Saunders has also served as a non-executive director for The WD-40 Company a global consumer products company with an icon brand. She Chairs the Compensation Committee, and also serves on the Nominating/Governance and Audit Committees. From April 2016 to January 2017, Ms. Saunders was U.S. President of NakedWines.com, a global wine company that uses crowdfunding to fund independent wine makers and direct ships wine to customers. From September 2014 to April 2016, Ms. Saunders was U.S. President of FTD, Inc. (NYSE:FTD), a global floral and gifting company. From August 2012 to January 2014, Ms. Saunders was President of Redbox, an entertainment company that is owned and operated by Coinstar, Inc. (NASDAQ:CSTR). From March 2009 until January 2012, Ms. Saunders was Executive Vice President and Chief MarketingFinancial Officer for Knowledge Universe, a privately-held early education company with over 1,600 schools nationwide. From February 2008 until March 2009, Ms. Saunders wasat Recreational Equipment, Inc. (REI), the nation’s largest consumer co-operative bringing top-quality outdoor gear, apparel, expert advice and experiences to its members and customers. Kelley leads REI’s strategy, sustainability, financial planning and analysis, accounting, treasury, internal audit, tax, strategic sourcing and asset protection teams. Kelley also leads REI’s integrated value chain team, including global supply chain operations and merchandise/demand planning. Prior to REI, she served as Senior Vice President, Consumer Bank ExecutiveChief Accounting Officer, and from May 2007 until February 2008,Treasurer for Nordstrom, Inc. where she was Seniorsupported strategic efforts to evolve Nordstrom’s accounting, indirect procurement, tax, and treasury work across the organization. Kelley also spent nine years at NIKE, Inc. and held various senior finance leadership positions, including Vice President Brand Executive,and Chief Financial Officer for Bank of AmericaNIKE, Inc.’s Enterprise Operations. Prior to NIKE, Kelley spent 14 years with Starbucks Corporation (NYSE:BAC). Between 2001 and 2007, Ms. Saunders heldin a variety of positions with Starbucks Coffee Co. (NASDAQ:SBUX),finance leadership roles, including Seniorseveral roles as Vice President Global Brand, during that company’s period of rapid domesticsupporting U.S. retail and international growth. Ms. Saunderscorporate finance. Since 2018, Kelley has also held executiveserved on the Board of Trustees for the Seattle Foundation, a community foundation focused on strengthening the health and senior management positionsvitality of the greater Seattle community by connecting generous people with eSociety, a B2B e-commerce

| 21 |

Our Board has determined that Ms. Saunders hasHall’s extensive experience as a strategic advisor to consumer and retail businesses as well as her finance and accounting expertise, among other things, makes her highly qualified to serve on the requisite experience to be a director of Nautilus. Ms. Saunders brings to our Board a strong background in marketing and building brands and provides Nautilus with additional expertise and understanding of the consumer marketplace.

Shailesh Prakash

Shailesh joined our Board in August 2005. Mr. Siegert is Chairman of the Audit CommitteeOctober 2021 and currently serves as a member of the Compensation Committee and the Nominating and Corporate Governance Committee. Mr. SiegertHe is currently retired but remains active by serving on company boardsthe General Manager and pursuing private investments. From JulyVice President of 2007 to September 2009 Mr. Siegert was employed by Hat World, IncGoogle News, where he leads product and Impact Sports, distributorsengineering teams building the future of team apparel. Prior to thatNews for publishers and consumers. Shailesh joined Google in 2022 from the Washington Post where he was Presidentthe Chief Product and Technology Officer, with responsibility for product, design, engineering and data analytics. At the Post he also headed the development of The Pyle Group,Arc XP, the fast-growing global content platform. Shailesh began his career as a private equity group,software engineer, with roles at Motorola, Sun Microsystems, Netscape and Microsoft. He holds a BS in Computer Science from December 1996 to July of 2007. Mr. Siegert previously worked at Rayovac Corporation,IIT, Bombay, a manufacturer of batteriesMS in Computer Science from Clemson University, and lighting products. An employeean MBA from 1970 to December 1996, his most recent position was Senior Vice President and Chief Financial Officer. Mr. Siegert earned his Bachelor’s degree in Accounting from U.W. Whitewater in 1970 and a Master’s degree in Management from U.W. Madison in 1976. He completed an eight-week program at MIT for Senior Executives during the spring of 1993. Mr. Siegert received U.W. Whitewater’s Beta Alpha Psi Outstanding Alumnus Award in 1987. He was also inducted into U.W. Whitewater’s School of Business Hall of Fame in 1994. Mr. Siegert currently serves on the following Boards: Uniek, Inc., Nautilus,Inc. and NorthStar Education Services ,LLC. He is a past member of both the University of Wisconsin Madison Foundation and the the U.W.-Whitewater Foundation. He previously served on the Board of Directors for GreenwoodsGeorgia State Bank,The Pyle Group LLC, Rayovac Corporation, Hy Cite Corporation, Behrens Acquisition,Inc., Great Lakes Educational Loan Services,Inc. and Georgette Klinger, Inc. Mr. Siegert is also a past member of the Nakoma Golf Club Board,Edgewood High School’s Board of Trustees, Edgewood’s Athletic Board, National Association of Accountants, Planning Executives Institute, In Business Advisory Board, and West Metropolitan Business Association. He is an avid supporter of the U.W. Madison Athletic Program including membership in the Mendota Gridiron Club and The Overtime Club.

Our Board has determined that Mr. Siegert hasPrakash’s extensive experience with technology development, digital platforms, software-as-a-service and subscription businesses, among other things, makes him highly qualified to serve on the requisite experience and expertise to be a director of Nautilus. As a former President and Chief Operating Officer of a private equity investment group and former Chief Financial Officer of a privately-held global consumer products company, Mr. Siegert brings a particular expertise toBoard.

Ruby Sharma

Ruby joined our Board in May 2022 and currently serves as the areasChair of consumer products, investor relationsthe Audit Committee and financial strategies.

Ruby retired as a senior partner at Ernst & Young LLP (“EY”) with a proven capacity to develop and manage new business ventures, and generate sustained revenue growth. A frequent keynote speaker and panelist on corporate governance topics, Ruby has authored several audit committee handbooks and guides, as well as white papers on governance, value protection, and diversity and inclusion topics.

Ruby was honored as an Outstanding 50 Asian Americans in Business in the Americas in 2011 by the Asian American Business Development Center. She is a Fellow Chartered Accountant (Institute of Chartered Accountants in England & Wales) and holds a B. A. in Economics from Delhi University, India. Sharma also attended the Executive Education program for EY Partners at Northwestern University, Kellogg School of Management.

Our Board has determined that Ms. Sharma’s considerable experience as a strategic advisor to public company boards and management teams and comprehensive background in M&A, Governance, Audit & Accounting, among other things, makes her highly qualified to serve on the Board.

| 22 |

No family relationship exists among any of the directors or executive officers. No arrangement or understanding exists between any director or executive officer and any other person pursuant to which any director was selected as a director or executive officer of Nautilus.

NAUTILUS’ BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE ABOVE-LISTED NOMINEES TO THE BOARD OF DIRECTORS. |

Our Board oversees our overall performance on behalf of our shareholders. Members of our Board stay informed of our business through discussions with our Chief Executive Officer (“CEO”) and other members of our executive team, by reviewing materials provided to them, and by participating in regularly scheduled Board and committee meetings.

Our Board met eightfourteen times in 2020 and all of ourFY 2023. All directors attended at least 75% of the meetings of our Board and of the meetings held by the committee(s)of committees of our Board on which theysuch member served that were held during the period in which such director served. Currently, we do not have a policy requiring our Board members'members’ attendance at the annual shareholders meeting. AllExcept for Richard A. Horn, Kelley Hall and Shailesh Prakash, all of our directors attended our 20202022 annual shareholders meeting.

In order to promote open discussion among independent directors, our Board has a policy of conducting executive sessions of independent directors during each regularly scheduled board meeting and at such other times if requested by an independent director. These executive sessions are generally led by our Chairman.

Transactions with Related Persons

Our Board recognizes that “transactions” with a “related person” (as such terms are defined in Item 404 of Regulation S-K) present a heightened risk of conflict of interest and/or improper valuation (or the perception thereof) and, therefore, has adopted a policy which shall be followed in connection with all related person transactions. Specifically, this policy addresses our procedures for the review, approval, and ratification of all related person transactions.

Our Board has determined that the Audit Committee is best suited to review and approve related person transactions. Accordingly, any related person transactions recommended by management shall be presented to the Audit Committee for approval at a regularly scheduled meeting of the Audit Committee. Any related person transaction shall be consummated or shall continue only if the Audit Committee approves the transaction, the disinterested members of our Board approve the transaction, or the transaction involves compensation approved by the Compensation Committee.

Committees of the Board

Our Board currently has three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Each committee is governed by a written charter that may be amended by our Board at any time. The full text of each committee charter, our Code of Business Conduct and Ethics, and our Corporate Governance Policies are available onin the Investor section of our website located at www.nautilusinc.com. In addition, we will promptly deliver free of charge, upon request, a copy of the committee charters, Code of Business Conduct and Ethics and our Corporate Governance Policies to any shareholder requesting a copy. Requests should be sent to the Nautilus, Inc. Secretary at the address provided on the first page 1 of this Proxy Statement.

| 23 |

The current composition of our three standing committees is as follows:

Name1 | Audit Committee2 | Compensation Committee2 | Corporate Governance Committee2 | |

Anne G. Saunders |  | |||

Patty Ross |  |  | ||

Ruby Sharma |  | 3 |  | |

Kelley Hall |  | 3 |  | |

Shailesh Prakash |  |  | ||

1All Committee members qualify as an “independent director” under our Corporate Governance Policies, Section 303A.02 of the Listed Company Manual of the New York Stock Exchange (“NYSE”), and applicable rules of the SEC, and each such person is free of any relationship that would interfere with the individual exercise of independent judgment.

2Our Board has further determined that each member of the Board’s Audit Committee

3Qualifies as an “audit committee financial statements and other financial information furnished by Nautilus, (ii) our compliance with legal and regulatory requirements, (iii) our system of internal

| Indicates Committee Chair |

Audit committee

Membership1 | Key Committee Responsibilities |

Ruby Sharma, Chair* Anne G. Saunders Kelley Hall* *Qualifies as an audit committee financial expert Meetings in FY 2023: 4 | Select, and evaluate the performance of, the Company’s independent registered public accounting firm (including its qualifications, performance and independence); |

Review and discuss with management and our independent registered public accounting firm the content of our financial statements prior to filing our quarterly reports on Form 10-Q, and the annual audited financial statements prior to the filing of our annual report on Form 10-K, including disclosures made in management’s discussion and analysis of financial condition and results of operations, and recommend to our Board whether the audited financial statements should be included in our annual report on Form 10-K; | |

Oversee the Company’s systems of internal accounting and financial controls and review the activities and qualifications of the Company’s internal audit function; | |

Review and discuss risk management and controls, including policies and guidelines with respect to risk assessment and risk management; | |

Review and approve related party transactions for potential conflicts of interest; and | |

Oversee the processes for handling complaints relating to accounting, internal accounting controls and auditing matters. |

1During FY 2023, Mr. Marvin G. Siegert, Mr. Richard A. Horn, and independence, (v) the performance of our internal audit function, and (vi) compliance with our code of business conduct and ethics.

| 24 |

•Compensation committee

Membership1 | Key Committee Responsibilities |

Patty Ross, Chair2 Shailesh Prakash Kelley Hall Meetings in FY 2023: 7 | Approve the compensation of each of the Company’s executive officers who are, as determined from time to time by our Board, subject to the provisions of Section 16 of the Exchange Act (the “Senior Executives” or “Section 16 Officers”), and approve (as appropriate) employment agreements and severance plans; |

Review the CEO’s individual goals and objectives and set the CEO’s compensation after evaluating his performance; | |

Review, approve and make recommendations to the Board regarding equity-based plans and incentive compensation plans in which the CEO and the other Senior Executives may participate; | |

Approve grants of stock options, restricted stock awards and/or other awards under our Amended and Restated 2015 Long-Term Incentive Plan (the “2015 LTIP”); | |

Recommend to the Board compensation of the non-employee Board members; | |

Develop and periodically review with the Board succession plans with respect to the CEO and other senior executives; and | |

Administer the Company’s clawback policy. |

1haveDuring FY 2023, Mr. M. Carl Johnson, III, Mr. Seigert, Mr. Horn, and Ms. Saunders served on the sole authorityCompensation Committee until the August 2022 annual meeting.

2Mr. Prakash served as Chair of the Compensation Committee from August 2022 until May 2023 when Ms. Ross was elected Chair of the Committee.

| 25 |

Corporate Governance COMMITTEE

Membership1 | Key Committee Responsibilities |

Patty Ross, Chair Shailesh Prakash Ruby Sharma Meetings in FY 2023: 4 | Evaluate the performance, size and composition of the Board to determine the qualifications and areas of expertise, including a diversity of experience and backgrounds, needed to further enhance the composition of the Board and working with management in attracting candidates with those qualifications; |

Identify individuals qualified to become directors and review the qualifications of prospective nominees, including nominees recommended by shareholders, and recommend to the Board candidates for election at the Company’s Annual Meeting of Shareholders and to fill Board vacancies; | |

Recommend to the Board committee chairs and members, as well as changes in number or function of committees; | |

Establish procedures, subject to the Board’s approval, for the annual performance self-evaluation of the Board and its committees; | |

Periodically review the Company’s corporate governance practices and leadership structure; | |

Develop and oversee the Company’s orientation program for new directors and an education program for all directors; and | |

Monitor progress of the Company’s ESG initiatives and performance. |

1During FY 2023, Mr. Johnson, Mr. Seigert, Mr. Horn, and responsibility to select, evaluate and, where appropriate, replace our independent registered public accounting firm;

•The Audit Committeediscuss polices developed by management and our Board with respect to risk assessment and risk management and steps management has taken to monitor and control financial risk exposure, including anti-fraud programs and controls;

During 2020,FY 2023, the Audit Committee consisted of fivethree independent directors: Marvin G. Siegert (Chairman)Ruby Sharma (Chair), Richard A. Horn, Patricia M. Ross and Anne G. Saunders, and Kelley Hall. Mr. Ronald P. Badie was a member until his retirementMarvin G. Siegert, Mr. Richard A. Horn, and Ms. Patty Ross served on May 1, 2020. Ms. Ross was appointed to the Audit Committee in March 2020.from the prior fiscal year end until August 2022. Each member of the Audit Committee meets the independence, financial literacy and experience requirements contained in the corporate governance listing standards of the NYSE relating to audit committees. In addition, our Board has determined that Messrs. HornMs. Sharma and SiegertMs. Hall each qualify as an “audit committee financial expert” under the regulations of the SEC. Although all members of the Audit Committee meet the current NYSE regulatory requirements for accounting or related financial management expertise, and our Board has determined that Messrs. HornMs. Sharma and SiegertMs. Hall each qualify as an “audit committee financial expert,” members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not technical experts in auditing or accounting. The Audit Committee met four times during 2020.

A copy of the full text of the Audit Committee Charter can be found on our website at www.nautilusinc.com.

| 26 |

The Compensation Committee

The Compensation Committee met sixseven times during 2020.FY 2023. Pursuant to its charter, the Compensation Committee has the authority, to the extent it deems necessary or appropriate, to retain compensation consultants,

A copy of the full text of the Compensation Committee Charter can be found on our website at www.nautilusinc.com.

Compensation Committee Interlocks and& Insider Participation